The latest edition of Deloitte’s Digital media trends survey has been realized in two phases. A first survey was launched at the end of 2019, before Covid emergency. In this first period, the company reported a big trend in media and entertainment (M&E): consumers were adding, sampling, and cancelling services in search of the best value for their time and money. They subscribed to an average of 12 media and entertainment services, while also seeking more free and subsidized entertainment, such as ad-supported streaming video.

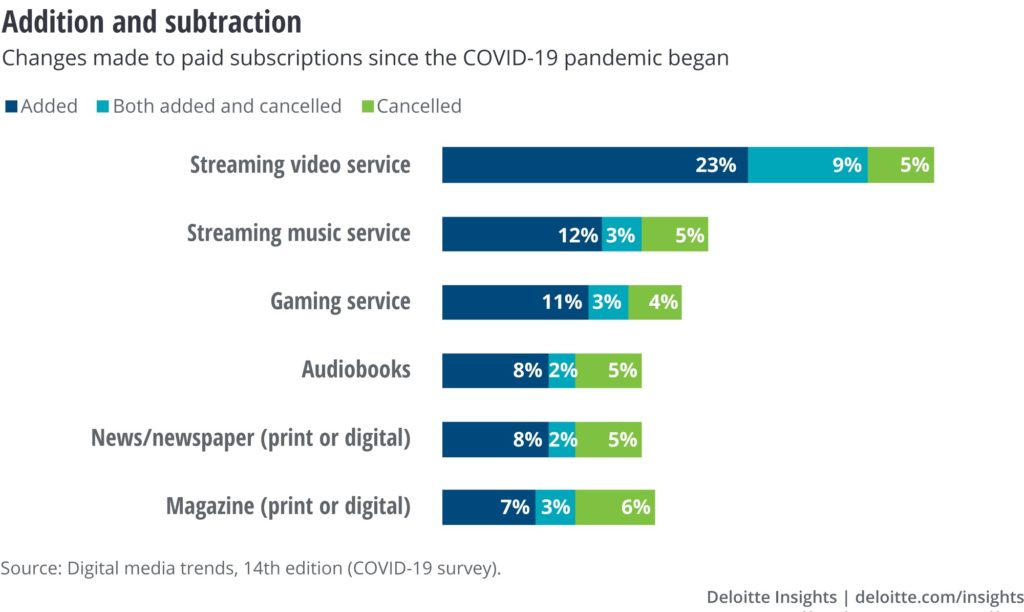

By the start of 2020, the rapid spread of the Covid-19 virus led Deloitte to launch a second survey to assess the impact of the emergency on US consumers and their media consumption. What has emerged is that customer acquisition has accelerated, especially in paid streaming video, music, and gaming subscriptions. “People have more time on their hands to watch, listen, and play games – Deloitte experts explain – and they are adding new services to get new content. More are trying new media and entertainment options that have been enabled or accelerated by the crisis. Social viewing, livestreaming, and first-run movies that release directly to digital services have all shown strong engagement during shelter-in-place guidelines. In difficult times, many turn to the solace of media and entertainment. At the same time, it is harder to keep customers—more are cancelling services. Introductory offers of free or reduced rates, along with compelling original content, are attracting subscribers. But they’re likely to cancel a service if the content dries up and they can’t justify the full price. The emergence of free, ad-supported alternatives makes it even more critical for subscription services to deliver value, especially since they’re up against growing competition from livestreaming video services and video gaming.”

A deep observation of the new trends for any specific customer targets is now fundamental to understand how create the best offer.

“How the pandemic and resulting economic repercussions will unfold is hard to predict – Deloitte says – and it remains uncertain how much of these behaviors will persist afterward. But the opportunities and challenges facing media and entertainment companies are getting clearer, along with the questions executives should ask themselves to take advantage of windfalls, recover from setbacks, and thrive in the decade to come.”