According to an analysis by Norbert Herzog, expert of GfK, it is fundamental for the on-line operators to organize their offer at a regional level, understanding the peculiar situation of consumers and of the specific market.

According to an analysis by Norbert Herzog, expert of GfK, it is fundamental for the on-line operators to organize their offer at a regional level, understanding the peculiar situation of consumers and of the specific market.

«How on-line retailers are seen in different markets – Norbert Herzog explains – is not just about the assortment mix offered or their pricing, it’s about the socio-economic market situation and the adoption level of on-line shopping.»

The GfK experts make two very significant examples of this. As he specifies, there are markets, where predominantly the more affluent consumers are also those who have access to on-line shopping: so retailers have responded by offering premium items. This is the case in Brazil, where on-line retail offers a premium assortment mix and generates high average prices. Facilitated by on-line promotions, consumers buy premium product segments at an attractive price which is reflected in an above-average price index of almost 140% compared to the total market covering online sales.

But the trand changes in other countries, such as China, where Internet shopping is highly adopted by consumers and on-line retailers employ a mass-market approach, facilitated by simple-to-use app-based payment systems, to sell lower-end product segments at entry-level prices. Hence, the price index is below 60%. For both markets, a convergence is visible – but they are still distant from a 100% price index average.

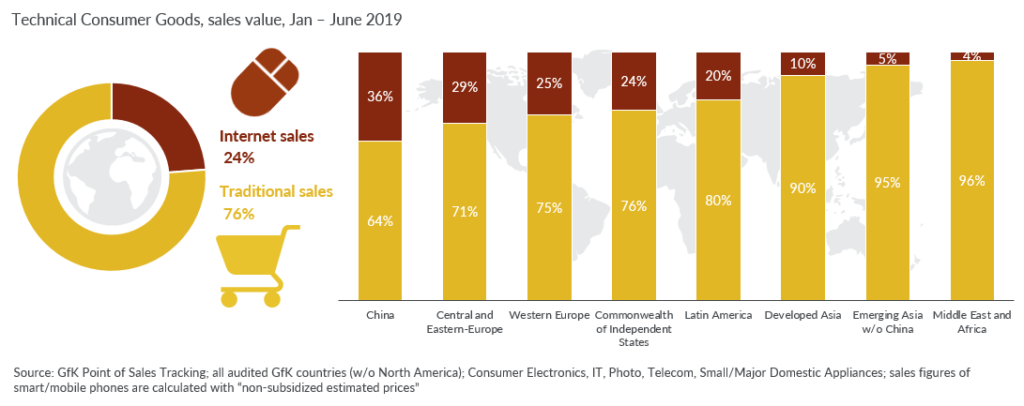

Of course, it is then opportune, take a look also to the sales results. E-commerce growth is slowing in countries where on-line shopping is more mature. Globally in the first half of 2019, e-commerce increased to about 24% of total revenues (+1.6 percentage points), a flattening dynamic compared to past years, when almost three percentage points were gained annually.

China is leading the on-line retail sector with a share of 36%. «In the Chinese and other advanced markets – Herzog says – there’s a blurring of on-line and traditional retail concepts. For instance, e-commerce players have been moving from pure on-line stores and integrating traditional shops into their retail ecosystem to reach customers regardless of channel.

Other regions are at a much earlier phase of the on-line retail evolution, such as Middle East/Africa and Emerging Asia (excluding China). Here, on-line sales account for about 5% compared to 36% of turnover in China.»