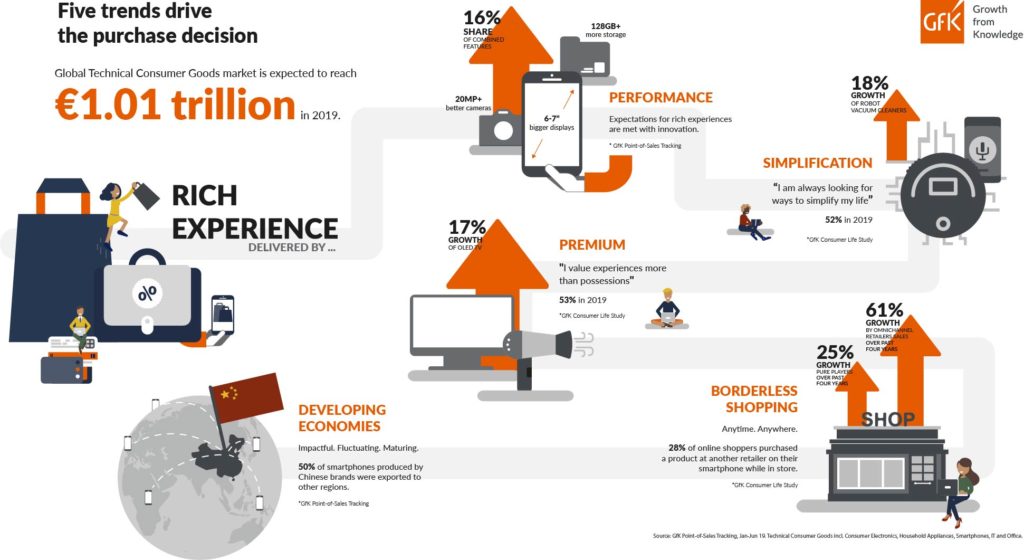

According to the latest data pubblished by GfK, the Major Domestic Appliances (MDA) market recorded a good trend in the first six months of the year. The market generated an overall value growth of 2.7 percent. For the full year GfK expects total sales will reach 182 billion euro, with a growth of 2 percent. The main trends contributing to the growth are performance/capacity, simplification and borderless shopping.

Looking at the regions, in the first half of 2019, the MDA market experienced a recovery in Brazil (+13 percent) and a strong uptake in India (+10 percent). Europe remained on a growth track contributing to the biggest part of absolute Euro growth. However, a 6.2 percent decline in China was a major reason for the overall market slowdown.

Norbert Herzog, GfK expert for the MDA industry comments: «Size definitely matters for consumers when considering major domestic appliances. Capacity is a long-term driver of all major markets. This translates into increasingly larger loading capacities in washing machines, taller and wider refrigerators, and more spacious oven cavities. As an example, sales of washing machines with 9 kg or more capacity grew by 24 percent.»

A very positive trend is visible also for small domestic appliances (SDA) that continued to grow during the first half of 2019. The global market (excluding North America) showed growth with an overall increase of 9.3 percent delivering a total market value of 24.3 billioneuro. GfK expects an SDA global sales growth of 9.4 percent for the full year of 2019. The top five segments (vacuum cleaners, food preparation, hot beverage makers, air treatment and shavers) contribute almost 50 percent of the SDA category. Over 23 percent of global growth is attributed to vacuum cleaners. The strongest growth region has been APAC, particularly the Emerging Asia region. Sales in APAC increased by 21 percent to 5.8 billion euro in the first half of 2019 compared to the same period last year. Product categories such as cordless handstick vacuum cleaners (+27 percent), robot vacuum cleaners (+18 percent), air treatment (+19 percent) and water filters (+14 percent), are primarily responsible for this growth.