Ceced Europe presented the first report about the ‘Home Appliance 2025 vision’, a challenge that goes on with the mission of re-launching the appliances industry and promototing its sustainability.

By Tiziana Corti

After about two years after the official launch of the HA2025 project (Home Appliance 2025), Ceced Europe published a report ( http://www.ceced.eu/HA2025_report/), full of facts, figures and information about the appliance industry operating in the Old Continent (also available the video: https://www.youtube.com/watch?v=uRzVo1vSS2E&t=42s).

Introduced in April 2015, HA2025 is a “ten-year vision” for the recovery of the industry through a concrete program, submitted to the European Commission, to which Ceced has repeatedly explained the value of this sector, not only for the manufacturing, but for the whole Community, for its economy and for all citizens.

Just the European Commission, moreover, has imposed some objectives for the energy saving both to ensure sustainable economic growth and to reduce the dependence of the Union from non-EU supplies.

Hence the key role of the appliance and its players which, with the product and process innovation and the revision of the entire lifecycle of the appliances, can contribute significantly to achieve the targets proposed by the EU.

The HA2025 project is a very concrete initiative, which focuses on four specific areas in which lies the home appliances potential:

| Achieve smarter and better regulation | Advance sustainable lifestyle | Make the connected home a reality | Accelerate Europe’s economic growth |

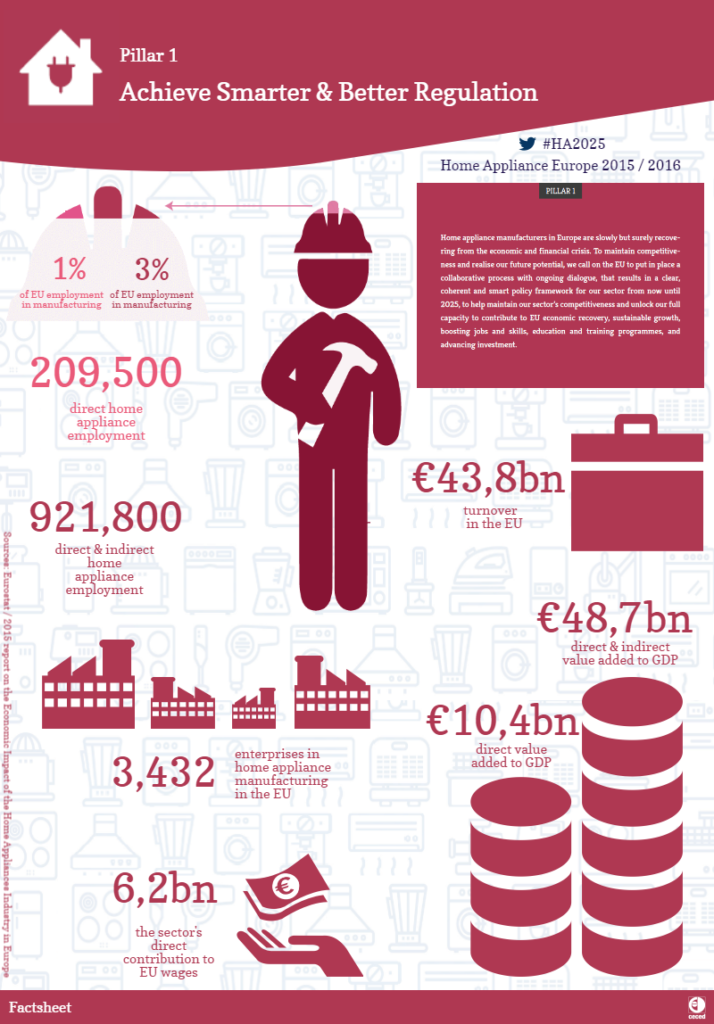

Home appliance: a 40 billion euro industry

The home appliance industry in the European area reaches a turnover of over 40 billion euro, thanks to the work of more than 3,400 companies with about 209,000 direct employees and almost 922,000 workers between direct and indirect.

So it is a very important sector for employment and economic development.

But it is also a sector that has brought, and continues to bring, great improvements in the daily lives of citizens, in the environment respect, in the sustainable growth and the saving of resources, such as energy, water and raw materials.

Thanks to significant investments in research and development and introduction of new highly advanced technologies, the installed base of household appliances in the homes and those proposed on the market boasts a high energy efficiency.

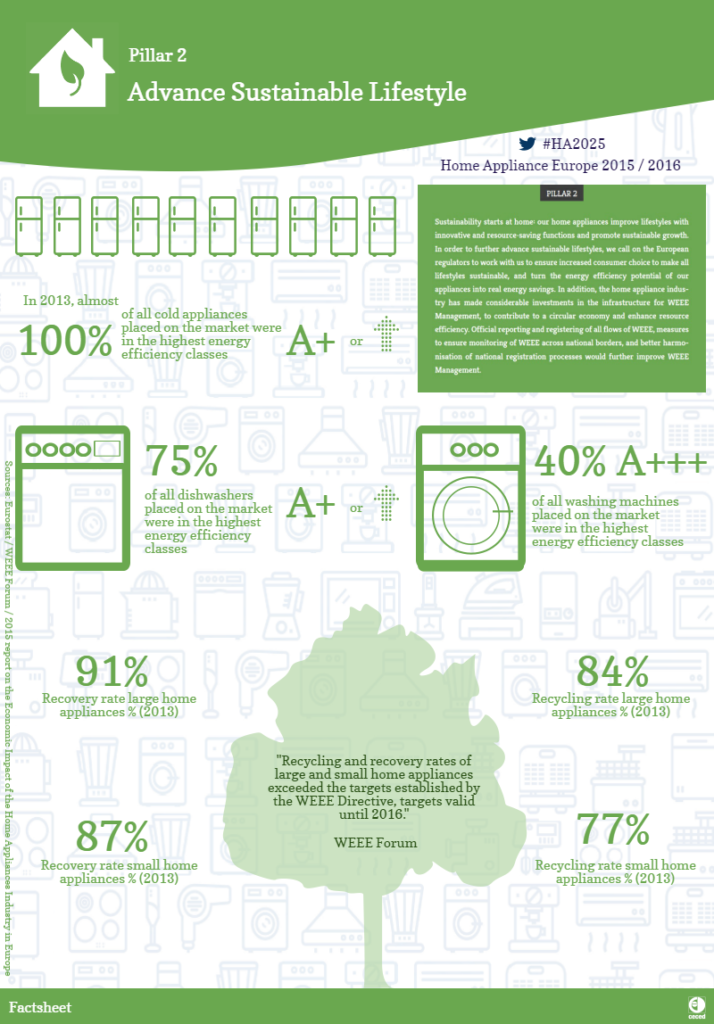

We can see great improvements in the diffusion of connected devices and other innovations, to subsidize which, only in 2014, the industry has invested 1.4 billion euro in research activities, depositing in the previous year 11,562 patents, that represent 8% of all those registered in the EU in the same period.

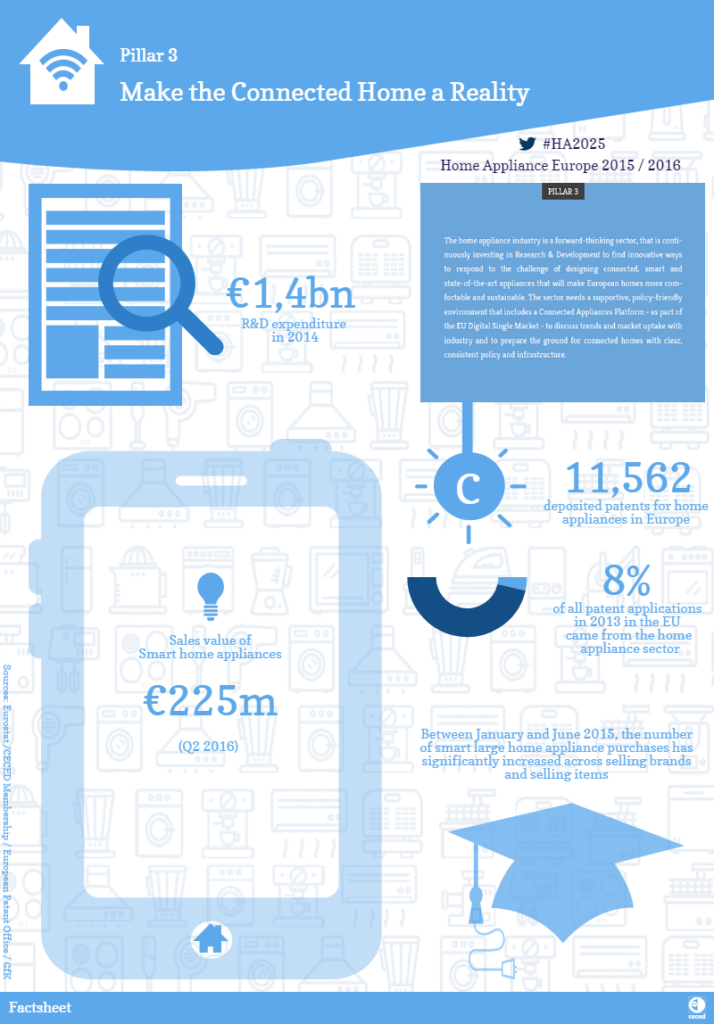

This level of innovation allows the European household appliance industry to make a significant contribution to the economic growth of the Continent, as reflected in the export figures: in 2015 the value of exported major appliances outside EU reached 3,741 million euro, while that of small appliances was equal to 2,624 million euro.

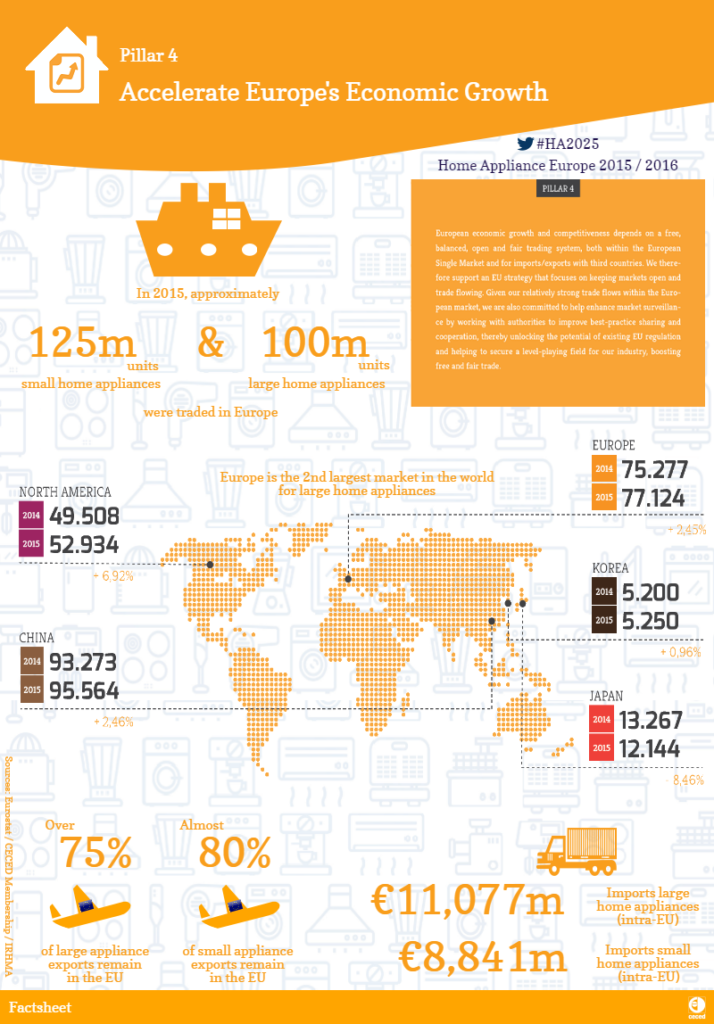

ACHIEVED TARGETS IN SUSTAINABILITY

| Energy efficiency: cooling appliances | almost 100% in A+ class or higher |

| Energy efficiency: dishwashers | 75% in A+ class or higher |

| Energy efficiency: washing machines | 40% in the highest A+++ class |

| Recovery rate % – large home appliances | 91% |

| Recovery rate % – small home appliances | 87% |

| Recycling rate % – large home appliances | 84% |

| Recycling rate % – small home appliances | 77% |

APPLIANCES TRADE – IMPORT/EXPORT

| Major appliances | |

| Traded major appliances in EU | 100 million units |

| Imports (intra EU) | 11,077 million euro |

| Exports (intra EU) | 11,349 million euro |

| Imports (extra-EU) | 5,997 million euro |

| Exports (extra-EU) | 3,741 million euro |

| Small appliances | |

| Traded small appliances in EU | 125 million units |

| Imports (intra EU) | 8,841 million euro |

| Exports (intra EU) | 8,819 million euro |

| Imports (extra EU) | 6,894 million euro |

| Exports (extra EU) | 2,624 milioni di euro |

Source: Ceced Europe –2015

Coherent policies to unlock the sector potential

To growth again like in pre-crisis years, the home appliance industry cannot do without a constant dialogue and a fruitful cooperation with the European Union institutions, to which Ceced asks for a clear, coherent regulatory system that allows industry to develop its potential, remaining competitive and increasing its contribution to economic and sustainable growth of all the Union, also supporting the employment.

As shown by the Eurostat figures, in the 28 EU Member States between 2012 and 2013, the number of home appliance companies decreased from 3,632 to 3,432, but it is anyway a remarkable figure, a patrimony to safeguard, that must not weaken but strengthen.

In 2013 Italy was the second country with a highest number of companies operating in the sector with 493 enterprises, only preceded by Czech Republic which had 609, while the UK and Germany were classified in third and fourth place, respectively, with 288 and 273 companies.

According to Eurostat again, from 2008 to 2011, the total turnover generated by the 28 EU Member States suffered a severe decline, falling from 52,400 million euro to 45,300 million, but from 2012 to 2014 the turnover started to recover, going up from 43,607 million euro in 2013 to 43,786 million the following year, thus showing its propensity for recovery.

| Country | Home appliances sector –

turnover 2014 (million euro) |

Trend %

2008-2014 |

| Austria | 820 | -31% |

| Belgium | 304 | -11% |

| Bulgaria | 277 | +22% |

| Croatia | 33 | -75% |

| Cyprus | 9 | -68% |

| Czech Republic | 622 | -7% |

| Denmark | 114 | -48% |

| Estonia | 3 | n.d. |

| Finland | 123 | -45% |

| France | 3,857 | -19% |

| Germany | 13,939 | +5% |

| Greece | 311 | -34% |

| Hungary | 1,219 | -1% |

| Ireland | 109 | n.d. |

| Italy | 8,611 | +27% |

| Latvia | 800 | n.d. |

| Lithuania | 122 | +40% |

| Luxembourg | 613 | -63% |

| Malta | 4,797 | +3% |

| Netherlands | 569 | +10% |

| Poland | 794 | +26% |

| Portugal | 439 | +1% |

| Romania | 1,147 | -15% |

| Slovakia | 2,613 | -34% |

| Slovenia | 469 | -59% |

| Spain | 213 | -32% |

| Sweden | 469 | -59% |

| United Kingdom | 213 | -32% |

Source: Eurostat

Sustainability starts at home

#SustainabilityStartsAtHome is a real motto for Ceced, promoted with countless international initiatives and activities in order to make people understand how important the choice and use of household appliances are for the European energy balance. Energy efficiency, also pursued by the policies and regulations of the European Commission, starts from the daily life of every citizen, to which the home appliances industry offers highly efficient products.

Between 2011 and 2013 the number of appliances in the highest class of efficiency has grown exponentially. Washing machines in A+++ class placed on the market in 2011 were 2.1 million. In 2013 this figure rose to 6 million. Moreover, in 2011, models in B class and lower disappeared, and those in A class decreased in a significant way.

The trend is the same also for the other appliances.

WASHING MACHINES PLACED ON THE MARKET (MILLION UNITS)

| 2011 | 2012 | 2013 | |

| A+++ class | 2.1 | 3 | 6 |

| A++ class | 2.7 | 3.8 | 3.8 |

| A+ class | 7.4 | 5.7 | 5.2 |

| A class | 2.2 | 1 | 0.2 |

| B class | 0 | 0 | 0 |

Source: Members of Ceced Europe

Connected home is already a reality

Innovations related to the home appliances connectivity are already under the eyes of all. Many products are now equipped with wi-fi connection and can be controlled remotely through different kind of App. Obviously also this area is the result of an incessant technological research undertaken by the home appliance industry (at the highest level), that is already able to provide consumers with smart and connected home.

But there are still many developments that lie ahead and, given the commitment required, even in this sector Ceced asks to EU its full cooperation and the establishment of a platform dedicated to the connected appliances within the EU Digital Single Market, to discuss the market trends and lay the foundation, also with the infrastructure, for the diffusion of the most advanced products.

The potential of this market can be seen from growing sales data. According to GfK, in fact, in the second quarter of 2016 revenues from the sale of connected devices in Europe reached 225 million euro compared to 88 million in the same period of 2015. The biggest value comes from the washing machine, which generated 66% of the turnover, but also the smart refrigerators are very appreciated with a share of 19%, while the share of the dryers is 5%.

CONNECTED APPLIANCES: TREND 2015-2016

| Q4-2015 | Q1-2016 | Q2-2016 | |

| Sales value connected appliances

(million euro) |

178 | 179 | 226 |

| Products share | |||

| Washing machines | 73% | 73% | 66% |

| Refrigerators | 15% | 15% | 19% |

| Others | 12% | 12% | 85% |

Source: GfK